What is Copy Trading? How does it work in 2024

January, 15th 2024

copy trading

Do you know whatis Copy Trading? Copy Trade is the use of social networks, automation tools, and signals to copy positions of other traders. For beginners, it may be an excellent method to touch the market with less effort and gain profit. It also helps traders learn from their successes and failures by monitoring the behavior of other traders. However, it is not effective for everyone, although there are many successful cases, because it is often associated with risk and can hardly be controlled. This article defines what is copy trading, how it works, and how it starts. We also examine the pros and cons of copy trade in the market.

What is Copy Trading?

Copy trading is the method of copying the trades of other experienced traders. There are things that are fully automated, semi-automated, and manual. Individuals can use copy trading to automatically copy other trader positions to open or close. Experienced traders can use signals to broadcast their positions through social networks and forums, allowing followers to imitate their approach. The definition of copy trading is similar to the definition of mirror crypto trading, but there is a difference in that traders are apathetic and imitate rather than imitate the top tactics. Traders can duplicate positions in various markets, such as forex, stocks, and CFDs. You can also duplicate prominent cryptocurrencies like Bitcoin (BTC) and important precious metals such as gold and platinum. Trading involves risk in all its forms. Therefore, traders need to investigate themselves and understand the mechanism before investing funds.

How Does Copy Trading Work?

What is copy trading? Many traders who try to mimic the trades of other traders are more focused on the success of their trades than on the markets they trade. Of course, you may follow traders who specialize in cryptocurrency trading. Here is how to duplicate cryptocurrency transactions.

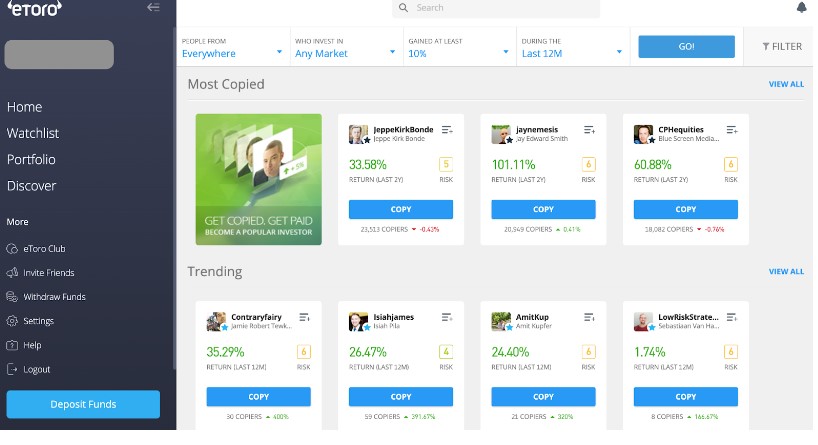

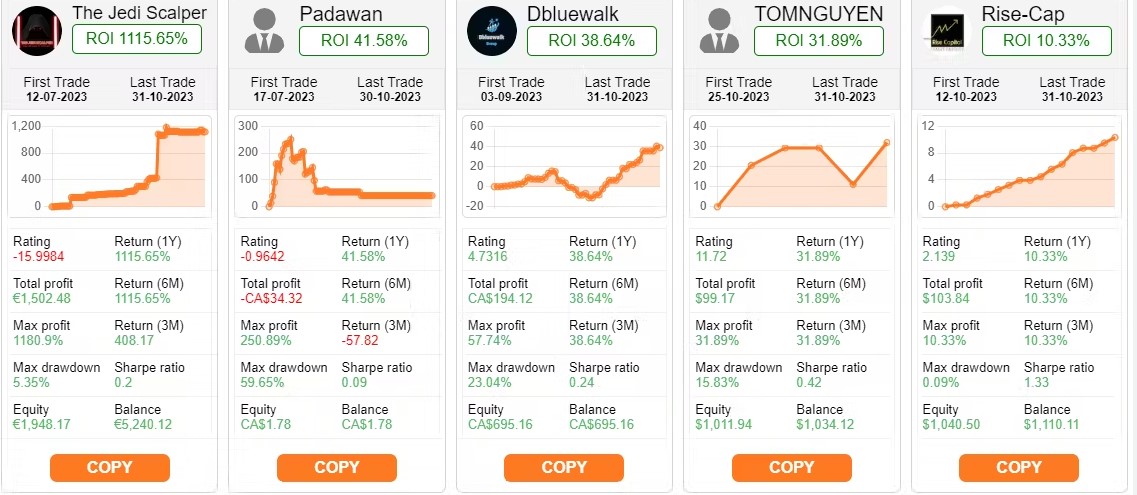

Step 1.Look for traders who are willing to copy trading

Filter vendors based on their location, the markets in which they invest (Forex, crypto, items, stocks, indices, or ETFs), their earnings margin from the previous month (and up to two years), and other criteria. eToro USA LLC does not provide CFDs or genuine crypto assets.

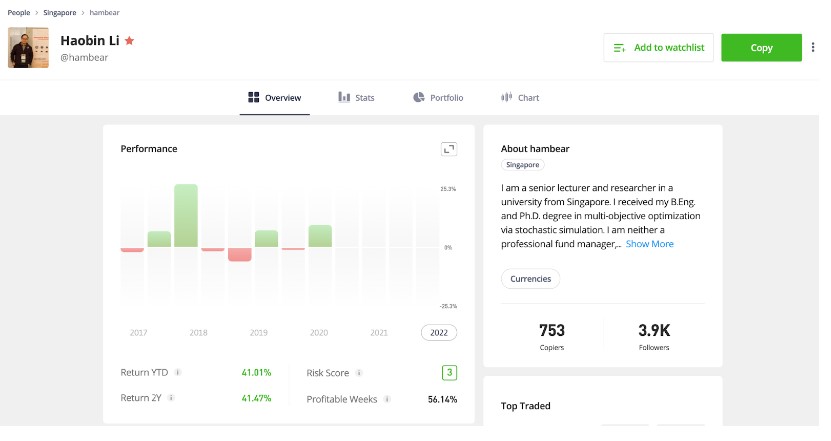

Step 2. Choose one trader to apply the copy trading method

After filtering and selecting the trader that specializes in your favored assets, you may see their profile for more thorough details. You can observe how many people are already following and replicating their moves.

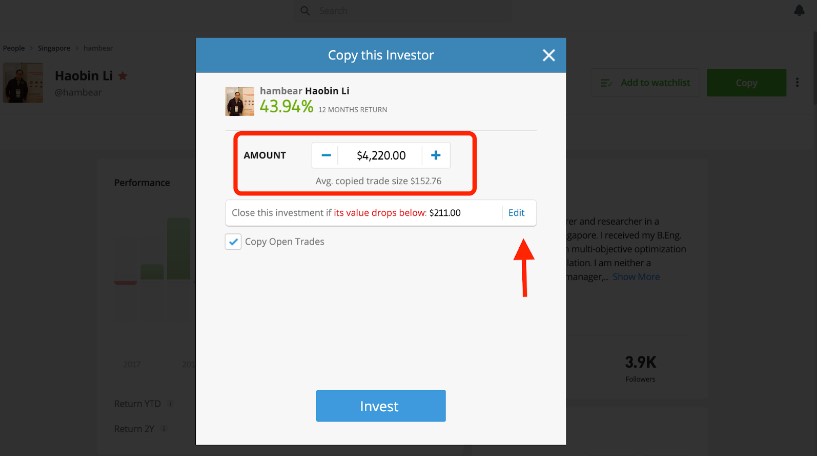

Step 3. Enable "copy trading."

Simply click the "Copy" button after selecting the trader you wish to copy. Before the platform can begin with what is copy trading, you must first configure the details for the traders. After you've determined the amount to invest and the exit strategy, click "Invest."

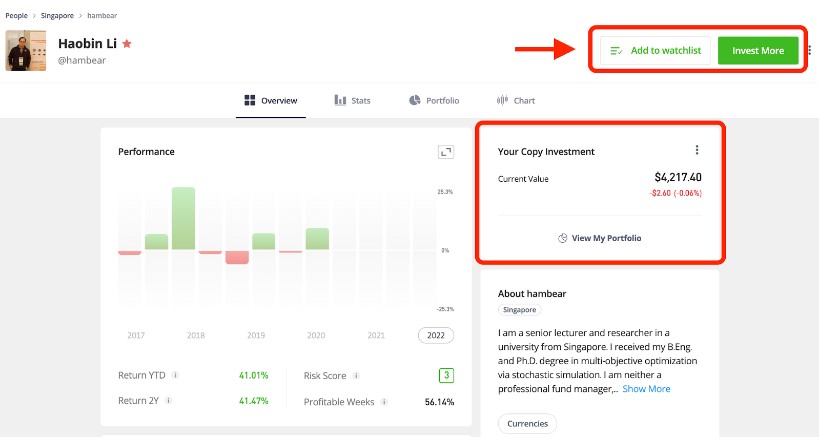

After you begin investing, your portfolio will have the same traders as the trader you just copied.

Step 4. Close the investments at any time

You'll see that you're now copying this trader. You will find all of the information about your copy investment on their page. The same information may be found on your portfolio page.

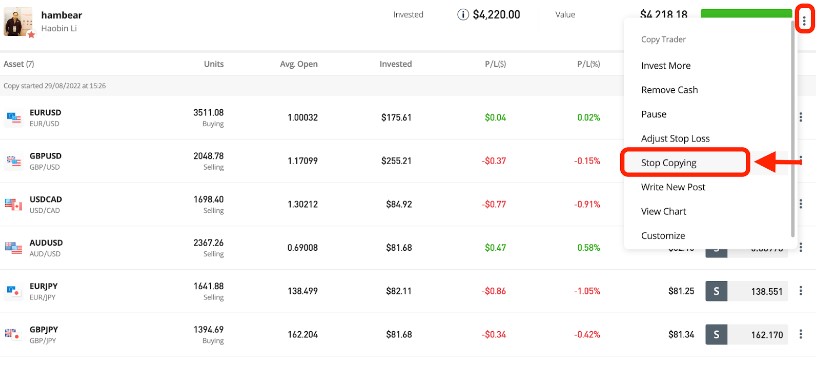

You can close this investment and stop following their traders at any moment. While there is no need to monitor your copy investment because the vendor you are copying is already doing so, you can choose to stop copying their assets. To do so, go to your portfolio, pick the trader you want to stop copying, and on their carrier, go to settings and select "Stop Copying."

Copy Trading Pros and Cons

Learn what copy is trading and how it works, and then introduce the pros and cons of copy trading that you need to know before copying trading.

Read more: Pros and Cons of Crypto Trading Bots: A Guide for Beginners

Advantages

Ideal for beginners:

CT allows traders to outsource research so they can start trading immediately. What's more, it's ideal for traders who don't have time to trade full-time.

Portfolio diversification:

Traders can gain trends and opportunities that cannot be gained unless they utilize the knowledge of other traders.

Maintaining Command:

CT offers a variety of risk management solutions. Copy traders can use a variety of copy strategies to set profit determination and loss levels.

Fees paid after profit:

Performance fees must be paid to mimic the trading behavior of the specified trader profile. However, the fee is required only when the profit is made.

Trading in multiple stock markets:

CT can be used in various markets such as foreign exchange, commodity, stock, index, metal, etc.

Cons

Risk - Even if you choose an experienced trader, the risk is extremely high. If the strategy fails, the risk may be transferred to the follower's account, and financial losses may be incurred.

Control - One of the most significant drawbacks is that traders lose control when they begin to duplicate their accounts.

Fees - Depending on the broker, a copy transaction may incur a commission. For example, OctaFX customers pay a separate master fee and are charged in USD per lot of transaction volume. A minimum deposit is required to invest in a trader. For example, eToro has a minimum deposit of $200.

Generally unavailable in the United States (US) - copy trading is rarely available in the United States due to the Dodd-Frank Act, which restricts lenders from protecting U.S. customers from harmful procedures.

What is Copy Trading Strategy:

It's critical to analyze what is copy trading and how your trading approach compares to that of the suppliers you want to copy.. This ensures that there is no significant difference in risk tolerance, for example.

Consider the following key strategic considerations:

Risk - Determining risk tolerance - How much market volatility can be withstood and what alerts and tools are used to manage risk.

Markets - Which financial markets do you want to invest in? Popular markets include forex, stocks, indices, commodities, and cryptocurrencies. It is important to understand the market where you want to invest funds.

Fixed or flexible - How much do you want to control your funds? With a fixed, fully automated copy system, mirror trading can be done with minimal control and input. Those seeking greater influence and control may prefer a more open and flexible approach.

Research-Copy trading risks not doing enough research before customers invest large amounts of money. Traders must study what is copy trading and how it is beneficial. It is important not only to study the provider thoroughly before signing up but also to evaluate the trading performance on a daily basis after the funds are at risk.

Read more: What Is a Scientific Trading Robot and Why You Need One in 2023

Leverage - Leveraged copy trading allows you to increase position size with minimal initial investment. This means that duplicating the transactions of various suppliers can increase the potential for profit and diversify the portfolio. For example, CySEC-regulated services cannot provide leverage beyond 1:30.

Choosing your copy trading broker

Choosing a trusted copy trading broker is very important in the adventure of copy trading. Consider the following key factors:

Reliability and safety: Ensure that the selected broker is reliable and secure.

Transparency: Look for brokers that provide transparent reports on the performance of traders you can imitate.

Diversity:Competent brokers should provide a diverse set of traders to follow in order to disperse your risk.

Ease of Use and Support: User-friendly interfaces and excellent customer service are essential.

How to Open a Copy Trading Account

To create a copy trading account, first open a real-time account with a reputable and authorized online trading platform. Check the broker's privacy policy. Before copying an experienced trader, the trader must put cash in the trading account. After obtaining login credentials, it is usually possible to link a copy investment system to a live account using the online trading platform. The good news is that most trading operators provide instructions on how to do this. Once your account settings are successful, you can start duplicating transactions immediately. However, it is recommended to use educational information available on the Internet before copy trade. With a number of threads and debates dedicated to the issue of copy trade, joining one of many online groups will be helpful.

What markets are most fit to copy trading?

Copy trade is available in all markets, including stocks, currencies, indices, cryptocurrencies, and commodities in Australia and around the world. Consider the underlying risks of various assets, as is the case with any investment. Another reason why providers have a good understanding of the market and asset signals they are dealing with is liquidity risk.

Conclusion:

Recommended by colleagues and experienced traders, it seems great to start trading Bitcoin. But trading without understanding is similar to shooting your feet. The forex market is volatile, and without prior expertise, it could be a major loss. Trading is a company where users can make money by buying and selling digital currencies. It is considered an asset class, and several trading hubs serve this market. We completely review what is copy trading. One of the easiest ways to get money through an investment is through copy trading.

Read more:

Is Crypto Trading Bot Profitable? Everything You Need to Know

Is Bot Trading Better than Manual Trading?

How to Avoid Scams in Bot Trading World? Attention

Copyright ©2025 Refonte Infini-Infiniment Grand

Refonte Infini Support

Log in to save important details in your chat history. This will help us serve you better and enhance your chat experience.

You might be looking for